Advertising-based video on demand (AVOD) services are becoming more popular, especially as subscription-based on-demand services multiply and take up a larger share of consumers’ budgets.

What are AVOD services, how do they work, and what are the challenges they face? This complete guide answers these and other important questions.

What are Advertising-Based Video on Demand (AVOD) Services?

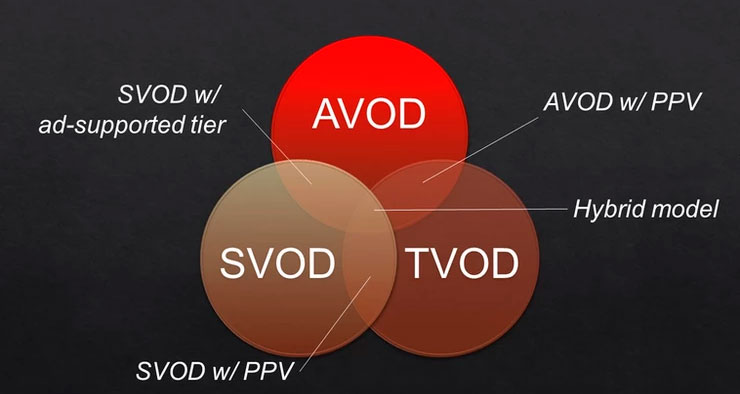

Advertising-based video on demand (AVOD) services provide free on-demand video content to viewers on an advertising-supported model. AVOD is one of three monetization models for on-demand content:

# AVOD (advertising-based video on demand) – provides free content supported by advertising, typified by services such as Pluto TV, The Roku Channel, Tubi, and YouTube

# SVOD (subscription-based video on demand) – provides content for a monthly subscription fee, typified by Disney+, HBO Max, Hulu, and Netflix

# TVOD (transactional video on demand, also known as pay-per-view or PPV) – provides paid content on a per-transaction basis, typically offered as a supplement to SVOD, cable, and satellite services

An AVOD service provides streaming content to viewers either on-demand or via «live» streaming channels, typically presented in a traditional channel grid. Unlike SVOD and TVOD services, no monthly subscriptions are necessary, and no transactional fees are charged. Instead, programming is supported by advertisers and has advertisements inserted at regular intervals. Unlike some SVOD services, ads on AVOD services cannot be skipped.

Some OTT services offer combinations of these three models. For example, some SVOD services (such as Hulu) offer ad-supported tiers with fewer or no commercials, and other SVOD services (such as Amazon Prime Video) offer PPV content in addition to the subscription content. A true hybrid model would combine all three types of monetization.

Appeals of the AVOD Model

According to Nielsen, AVOD services accounted for 26% of the streaming market in 2021, up from 24% the year prior – even as overall OTT subscriptions are down. There are many reasons why AVOD is so appealing to both viewers and programmers.

It’s Free

For consumers, nothing beats free. With viewers spending more money each month on more and more costly streaming video subscriptions, the appeal of a free streaming service— even if it’s supported by ads— is evident. As budgets tighten, expect more consumers to cut back their paid subscriptions and rely more on AVOD services.

Low Barrier to Entry

Unlike SVOD services that require viewers to subscribe to see what’s available, AVOD services are much easier for viewers to sample. The lower barrier to entry provides an easier path to new viewers.

Fewer Ads Per Hour

AVOD services tend to serve fewer ads per hour than traditional broadcast television, thus allowing for more viewer content—often in the form of fewer excised scenes in older television programming. Broadcast TV ad loads average close to 13 minutes per hour. In contrast, major streaming services with ad-supported levels, such as Discovery+ and Peacock, run no more than 5 minutes of advertising per hour. Even the pure AVOD players have relatively light ad loads, with most running less than 6 minutes per hour.

A lower ad load benefits both viewers and advertisers. Viewers have to sit through fewer ads, which results in higher satisfaction levels. Advertisers get less clutter and competition for their ads.

Easy to Monetize Self-Created Content

AVOD is a relatively easy way for creators to monetize their video content. Unlike other monetization methods (sponsorship, merchandise sales, etc.), advertising offers almost immediate gratification with little extra effort. AVOD is also appealing to companies engaging in content marketing via their own created videos.

Challenges to the AVOD Model

Despite the obvious benefits of the AVOD model, it is not without its challenges.

Ad Avoidance

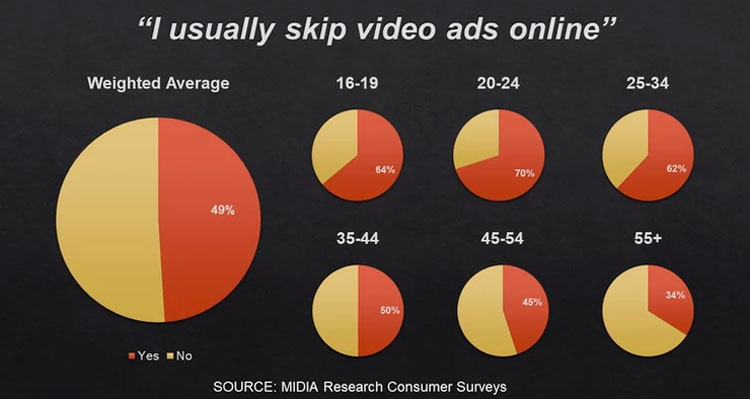

The big challenge with AVOD services is getting viewers not to skip or tune out the ads. MIDiA Research says that 49% of all viewers skip online video ads, with younger viewers more prone to skip than older ones. The key is to provide advertising that’s relevant to viewers, which requires more detailed tracking of audience demographics for AVOD programming.

Younger, Digital-Savvy Audience

According to MIDiA Research’s 2021 Consumer Survey, 30% of Pluto TV’s weekly active users (WAUs) are aged 25-34, as are a similar number (31%) of Tubi’s WAUs. This younger AVOD audience is more advertising-adverse than older viewers, with more than half (62%) generally skipping video ads.

That said, even though this digital-savvy audience tries to avoid ads in general, they tend to respond well to relevant advertising. This increases the value proposition for AVOD advertisers, especially those that can tailor their message to the younger AVOD audience.

High Inventory to Unique User Ratio Equals Commercial Repetition

Some AVOD services have experienced difficulty attracting large enough pool of advertisers. One of the drivers for this is over balance of ads slots per user. For OTTs with long average sessions this becomes a problem where they can’t source enough individual advertisers to fill the ad space. This can result in viewers getting bombarded with the same commercials over and over or being shown house ads/blank slate at a higher than desired frequency. Ad repetition can annoy and even drive away viewers. Publishers in this situation should consider options for restricting the volume of ads/user or expanding their footprint with additional sales channels.

Need More Viewers to Generate Similar Revenue

Subscribers generate more stable revenue than do advertisers. Vimeo found that they need a much larger AVOD viewer base to generate the same revenue as with monthly SVOD subscribers. This means that AVOD services need to increase their viewer numbers to keep pace financially.

Ad Delivery Failure

Poor connectivity, rebuffering, and startup delays can interrupt the ad viewing experience on AVOD services, costing AVOD services billions in lost revenues.

Penthera Can Help Increase AVOD Revenues

Penthera’s 2nd Look increases fill rates and CPMs on server-side ad insertion (SSAI) inventory for VOD. SSAI solves critical user experience problems, but introduces new monetization challenges for publishers, especially for programmatic ad sources. Ad decisions with SSAI on VOD must all be made before the video starts. Resulting issues with time-outs, bid density, and time-to-live expirations cause significant lost revenue. 2nd Look enables publishers to make real time ad requests with their existing SSAI infrastructure resulting in higher yield and increased revenue.