Apart from the importance of the personal return to NAB, there are doubts for some participants about the extent to which this edition of the NAB show will be justified in terms of numbers.

Attendance will undoubtedly be lower than in the years before the pandemic. However, there will be new opportunities in Las Vegas these days. Latin America offers many of these opportunities at NAB, even if fewer executives are present this time.In this new phase of the current content war – we go into more detail in a report on Prensariozone.com – marked by mergers and the launch of DTC services, these new proposals require major investments and technologies, while at the same time MSOs and large ISPs are launching their own OTT services. At the same time, broadcasters need to adapt to the new digital era, beyond the point where they are in the transformation to IP and the cloud, which is steadily progressing.

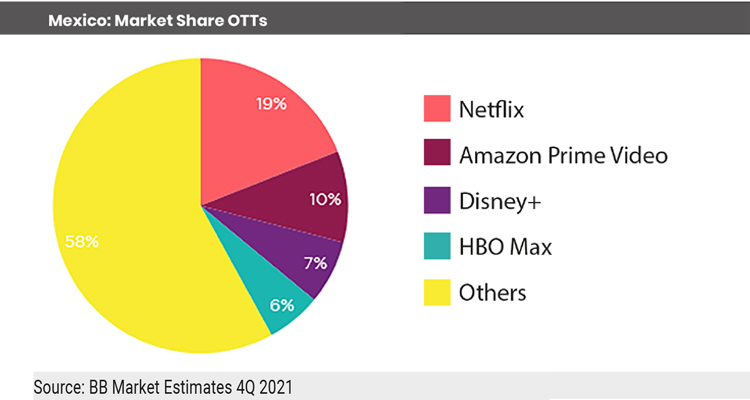

Latin America is experiencing this process firsthand in Mexico, as the new regional leader in the production bet of the major OTTs. The investment will exceed $800 million due to the penetration of new players in the market, such as Netflix (with more than 50 in-house productions produced in Mexico) and Amazon, which will invest $300 million in the coming years, along with Disney+, HBO Max and the new Vix from the Televisa-Univisión merger.

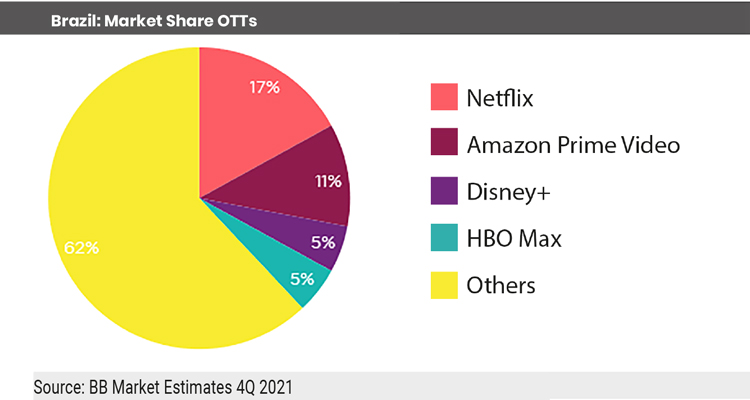

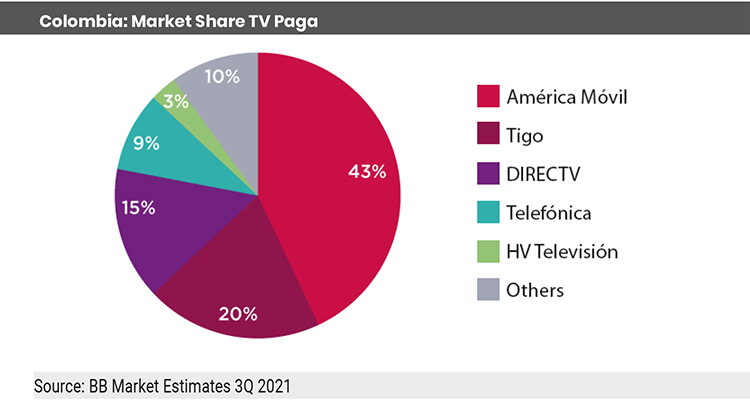

At the same time, Brazil is the market with the largest number of users of OTT services, with strongly consolidated launches such as that of Globoplay. Colombia is the third largest market in audiovisual production, due to the support of the local government. The rest remains stable and growing, including Argentina and Venezuela itself -see related report-.

Completing the transition to the cloud and offering DTC/OTT services

The global broadcast and video industry will have three pillars at NAB: Media Creation, Storytelling, Connect Capitalize; these pillars summarize the future of the industry in terms of media business and new technologies to improve the economics of content.

On the demand side, broadcasters face the new challenge of expanding the horizon of content creation and consumption options for the public with the aforementioned DTC (direct to consumer) streaming services. Meanwhile, 5G technology is advancing, which will enhance the user experience.

Five global strategies for the future

Looking at the long-term global evolution of the entertainment and media industry, he sees five key strategies for dealing with these changes and challenges.

They are Social Discovery (the process of finding users through social networks). Universe Building, which is about building a new universe or a comprehensive ecosystem with all its players and alliances. Agile Storytelling, which is very clear because there is also a coincidence that stories, will always remain valid on any platform. The pursuit of monetization, which has been the big challenge for all new platforms for more than 10 years, and still today for the big newspapers and traditional broadcasters. And finally, Workflow at Scale, which will clearly be part of the triumph in areas with such low margins or directly with companies – with the Silicon Valley model that generates critical mass, as opposed to Hollywood’s, which seeks profit – that are not necessarily looking for cost efficiency.